As JEPI ETF: Is This the Right Time to Buy? takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

JEPI ETF, or Just Enough Performance Index ETF, aims to provide investors with a diversified portfolio that tracks a specific index. In this article, we will delve into the key components of JEPI ETF, examine its historical performance, and explore factors that influence its market dynamics.

Overview of JEPI ETF

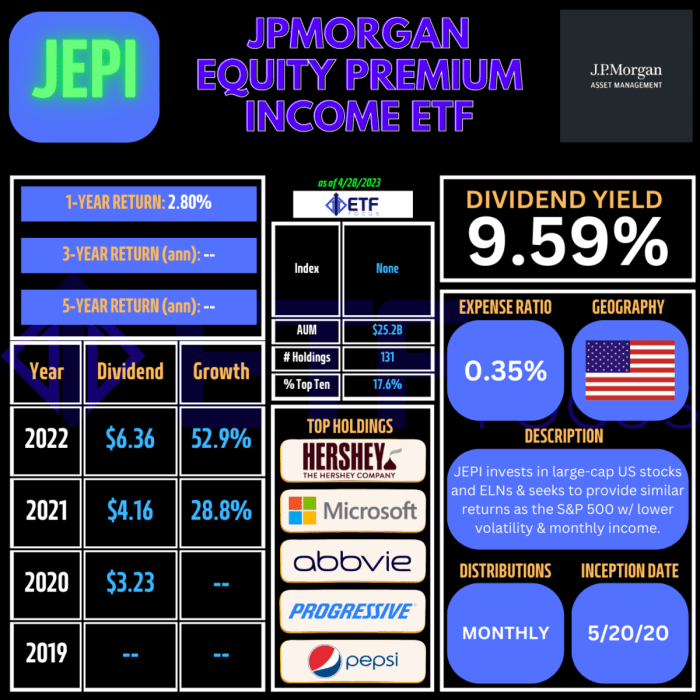

JEPI ETF, or the J.P. Morgan Equity Premium Income ETF, is an exchange-traded fund designed to provide income and growth potential by investing in a diversified portfolio of U.S. equity securities. The primary objective of JEPI ETF is to seek income and capital appreciation through exposure to a mix of large-cap, mid-cap, and small-cap stocks.

Key Components of JEPI ETF

- Asset Allocation: JEPI ETF allocates its assets across various sectors and market capitalizations to achieve a balanced exposure to the U.S. equity market.

- Income Generation: The fund aims to generate income through dividend payments from the stocks held in its portfolio.

- Options Strategy: JEPI ETF utilizes an options strategy to enhance income potential and manage risk in volatile market conditions.

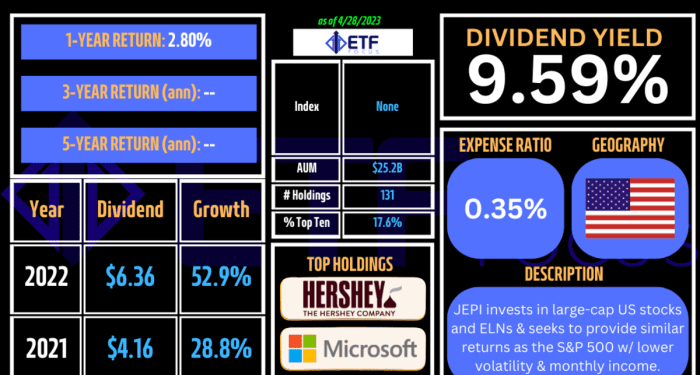

Historical Performance of JEPI ETF

JEPI ETF has shown a track record of delivering competitive returns over the years. Despite market fluctuations, the fund has managed to provide investors with a steady stream of income while participating in the potential upside of the equity market.

It is essential to consider past performance along with current market conditions when evaluating the suitability of JEPI ETF for investment purposes.

Factors influencing JEPI ETF

Investing in JEPI ETF is influenced by various market factors, global economic trends, and regulatory changes. Understanding these factors is crucial for making informed decisions.

Market Factors Impacting JEPI ETF

- Market Volatility: Fluctuations in the market can impact the performance of JEPI ETF, affecting the value of investments.

- Interest Rates: Changes in interest rates can influence the attractiveness of JEPI ETF compared to other investment options.

- Company Performance: The financial health and performance of the companies included in JEPI ETF can directly impact its value.

- Investor Sentiment: Market sentiment and investor behavior can drive buying or selling activity, impacting JEPI ETF prices.

Global Economic Trends and JEPI ETF

- Global GDP Growth: Economic growth trends in major economies can impact the overall performance of JEPI ETF.

- Currency Fluctuations: Changes in currency exchange rates can affect the value of international assets held within JEPI ETF.

- Trade Policies: Trade agreements and tariffs can influence the profitability of companies within JEPI ETF, impacting its performance.

Regulatory Changes Affecting JEPI ETF

- SEC Regulations: Changes in Securities and Exchange Commission regulations can impact the structure and operation of JEPI ETF.

- Tax Laws: Alterations in tax laws related to investments can affect the tax treatment of JEPI ETF holdings for investors.

- Compliance Requirements: Regulatory compliance requirements can impact the cost and operation of JEPI ETF, influencing its overall performance.

Comparison with similar ETFs

When comparing JEPI ETF with other ETFs in the same category, it's important to analyze the differences in holdings and performance trends to determine the best investment option.

Holdings Comparison

- JEPI ETF primarily focuses on technology and innovation companies, with a mix of large-cap and mid-cap stocks in its portfolio.

- On the other hand, some similar ETFs may have a higher concentration in specific sectors like healthcare or consumer staples.

- It's essential to review the top holdings of each ETF to understand the diversification and risk exposure provided by the fund.

Performance Trends

- Historically, JEPI ETF has shown strong performance due to the growth potential of the technology sector.

- Compared to its competitors, JEPI ETF may have outperformed during bullish market conditions but could be more volatile during market downturns.

- Investors should assess the risk-return profile of JEPI ETF against similar funds to align with their investment objectives and risk tolerance.

Timing considerations for buying JEPI ETF

Investing in JEPI ETF requires careful timing to maximize returns and minimize risks. Let's explore the current market conditions and upcoming events that could influence the decision to buy JEPI ETF.

Impact of current market conditions

- The overall market sentiment is positive, with economic indicators showing signs of recovery. This could bode well for JEPI ETF as it tracks the performance of companies with strong environmental, social, and governance practices.

- However, volatility in the market due to geopolitical tensions or economic uncertainties could also affect the performance of JEPI ETF. It's essential to monitor market trends closely before making a buying decision.

Upcoming events and announcements

- Key announcements from central banks or government policies related to sustainable investing could impact the performance of JEPI ETF. Investors should stay informed about any upcoming events that could influence the market.

- Earnings reports of companies included in JEPI ETF's portfolio can also sway investor sentiment. Positive earnings could attract more investors, leading to an increase in JEPI ETF's value.

Analysis of historical data

- Looking at historical data can provide insights into the performance of JEPI ETF during different market conditions. Analyzing past trends and returns can help investors determine if now is the right time to buy JEPI ETF.

- Comparing JEPI ETF's historical performance with similar ETFs or benchmark indices can also give investors a better perspective on whether JEPI ETF is currently undervalued or overvalued.

Conclusive Thoughts

In conclusion, JEPI ETF offers a unique investment opportunity for those looking to capitalize on market trends. Understanding its performance, comparing it with similar ETFs, and carefully considering timing factors can help investors make informed decisions. As the financial landscape evolves, staying informed about JEPI ETF can be crucial for maximizing investment potential.

Popular Questions

Is JEPI ETF suitable for long-term investment?

JEPI ETF can be a viable option for long-term investment due to its diversified holdings and potential for growth over time.

How does JEPI ETF differ from traditional mutual funds?

JEPI ETF trades on exchanges like a stock, offering intraday trading and typically lower expense ratios compared to traditional mutual funds.

What are the key market factors that impact JEPI ETF?

Market volatility, interest rates, and economic indicators can significantly influence the performance of JEPI ETF.

Are there any upcoming regulatory changes that could affect JEPI ETF?

Changes in regulations related to the financial industry or investment vehicles could impact the operations and performance of JEPI ETF.