In exploring the question of whether Shopify Capital Loan is a suitable option for small businesses, we delve into the intricacies of this financial tool, shedding light on its benefits and potential drawbacks. This article aims to provide a comprehensive guide for entrepreneurs seeking funding for their ventures.

Introduction to Shopify Capital Loan

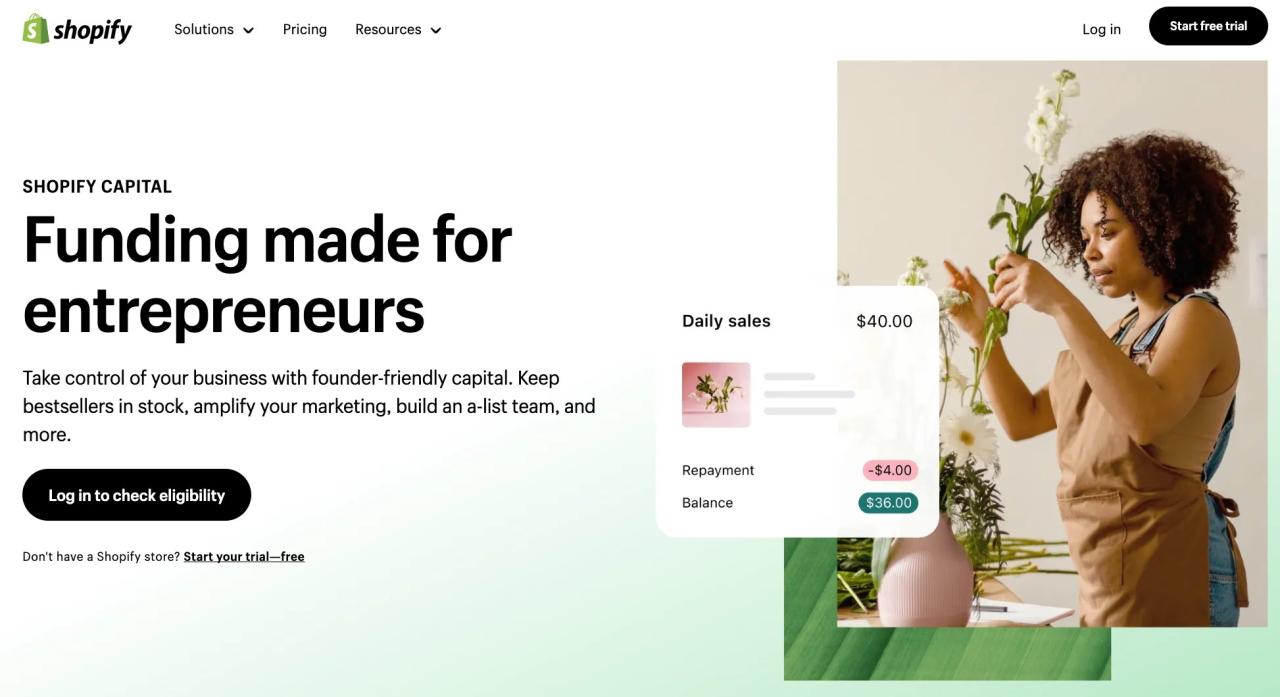

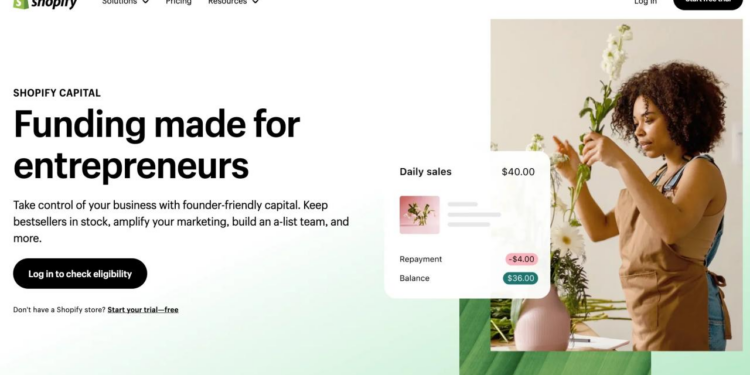

Shopify Capital Loan is a financing option offered by Shopify, a popular e-commerce platform, to help small businesses access funds for growth and expansion. The loan works by providing eligible businesses with a lump sum of money that is repaid through a percentage of daily sales on the Shopify platform.

Eligibility Criteria for Small Businesses

- Must be a registered Shopify merchant

- Minimum requirements for revenue and history of sales on the Shopify platform

- Good standing with Shopify in terms of payments and account status

Advantages and Disadvantages of Using Shopify Capital Loan

Using Shopify Capital Loan has its pros and cons that small businesses should consider before applying:

- Advantages:

- Quick and easy application process

- No fixed monthly payments, repayment based on daily sales

- No interest rates, only a one-time fixed fee

- Access to funds for inventory, marketing, or other business needs

- Disadvantages:

- Repayment can impact cash flow if sales are slow

- May not be suitable for businesses with inconsistent sales

- Small businesses may find the fixed fee expensive in the long run

- Restrictions on how funds can be used

Comparison with Traditional Business Loans

When comparing Shopify Capital Loan with traditional bank loans, there are several key differences to consider.

Differentiation

- Shopify Capital Loan

- Traditional Bank Loans

Application Process, Approval Time, and Repayment Terms

- Shopify Capital Loan:

- The application process for a Shopify Capital Loan is typically quicker and more streamlined compared to traditional bank loans.

- Approval time for Shopify Capital Loan is usually faster, with funds being disbursed promptly upon approval.

- Repayment terms for Shopify Capital Loan are often based on a percentage of daily sales, making it more flexible for small businesses.

- Traditional Bank Loans:

- Traditional bank loans usually involve a more extensive application process, requiring detailed financial documentation.

- Approval time for traditional bank loans can be longer, delaying access to much-needed funds for small businesses.

- Repayment terms for traditional bank loans are typically fixed monthly payments, which may be challenging for businesses with fluctuating cash flow.

Interest Rates and Fees

- Shopify Capital Loan:

- Interest rates for Shopify Capital Loan are fixed, with no compound interest or hidden fees.

- Fees associated with Shopify Capital Loan are transparent, making it easier for businesses to budget and plan for repayments.

- Traditional Bank Loans:

- Interest rates for traditional bank loans may vary, depending on the lender and the business's creditworthiness.

- Additional fees and charges are common with traditional bank loans, which can add to the overall cost of borrowing.

Benefits of Shopify Capital Loan for Small Businesses

Shopify Capital Loan offers a range of benefits that can help small businesses thrive and expand in the competitive market.

Flexibility and Growth Opportunities

One of the key advantages of Shopify Capital Loan is the flexibility it provides to small businesses. Unlike traditional loans, Shopify Capital Loan does not require a fixed monthly payment, making it easier for businesses to manage their cash flow.

This flexibility allows businesses to invest in growth opportunities such as expanding product lines, launching marketing campaigns, or improving their online presence.

Quick and Convenient Application Process

Applying for a Shopify Capital Loan is quick and convenient, with minimal paperwork and no credit check required. This streamlined process means that small businesses can access the funds they need in a timely manner, without the hassle of lengthy approval processes

Success Stories

- One successful small business that has utilized Shopify Capital Loan is XYZ Jewelry Co. With the help of the loan, they were able to purchase new equipment and expand their production capacity, leading to a significant increase in sales.

- Another example is ABC Clothing Boutique, which used the loan to launch a new online marketing campaign. This resulted in a boost in website traffic and a surge in online sales, helping the business reach a wider audience.

Risks and Limitations of Shopify Capital Loan

Taking a loan from Shopify Capital can be a beneficial option for small businesses, but it also comes with certain risks and limitations that need to be considered before making a decision.

Potential Risks Involved

- High-interest Rates: Shopify Capital loans may have higher interest rates compared to traditional bank loans, which can increase the cost of borrowing.

- Short Repayment Terms: The repayment terms for Shopify Capital loans are often shorter than traditional loans, leading to higher monthly payments that could strain a small business's cash flow.

- Impact on Credit Score: Defaulting on a Shopify Capital loan can negatively impact the credit score of the business owner, making it harder to secure future financing.

Impact of Defaulting on a Shopify Capital Loan

Defaulting on a Shopify Capital loan can have severe consequences for a small business. It can lead to:

- Legal Action: Shopify Capital may take legal action to recover the unpaid loan amount, which can result in additional costs and damage to the business's reputation.

- Loss of Assets: In some cases, defaulting on a loan could result in the seizure of business assets to cover the outstanding debt.

- Difficulty in Securing Future Financing: A default on a Shopify Capital loan can make it challenging for the business to secure financing in the future, as lenders may view the business as high risk.

Consequences of Not Repaying the Loan on Time

Not being able to repay a Shopify Capital loan on time can have serious repercussions, such as:

- Accumulation of Fees: Late payments on a Shopify Capital loan can result in additional fees and penalties, increasing the overall cost of the loan.

- Damage to Business Reputation: Failing to repay a loan on time can damage the reputation of the business and the business owner, making it harder to attract customers or partners.

- Risk of Bankruptcy: Persistent failure to repay a Shopify Capital loan can push a small business towards bankruptcy, leading to the closure of the business.

Tips for Small Businesses Considering Shopify Capital Loan

When considering a Shopify Capital Loan for your small business, it is important to weigh the pros and cons to make an informed decision. Here are some tips to help you determine if this type of loan is the right choice for your business:

Assess Your Business Needs

- Identify why you need the funds and how they will benefit your business in the long run.

- Consider if the loan amount aligns with your business goals and growth strategy.

- Evaluate your ability to repay the loan based on your current and projected cash flow.

Manage Funds Wisely

- Create a detailed budget outlining how you plan to use the loan funds to maximize their impact.

- Avoid using the funds for non-essential expenses that do not contribute to your business growth.

- Track your expenses and ensure that the funds are being utilized efficiently to achieve your business objectives.

Maximize Loan Benefits

- Utilize the loan to invest in areas of your business that will generate the highest return on investment.

- Take advantage of Shopify's resources and tools to optimize your online store and increase sales.

- Stay proactive in monitoring your business performance and make adjustments as needed to maximize the impact of the loan.

Last Word

As we conclude our discussion on the suitability of Shopify Capital Loan for small businesses, it becomes evident that this financing option offers a unique set of advantages and challenges. It is crucial for business owners to carefully weigh their options and make informed decisions to propel their enterprises towards success.

Query Resolution

Is there a minimum credit score required to qualify for a Shopify Capital Loan?

Unlike traditional bank loans, Shopify Capital does not have strict credit score requirements. The eligibility criteria are primarily based on your sales history and business performance on the Shopify platform.

How quickly can a small business receive funds after applying for a Shopify Capital Loan?

Once approved, funds from a Shopify Capital Loan are typically disbursed within a few business days, providing quick access to much-needed capital for small businesses.

Can a small business use Shopify Capital Loan for any purpose?

While there are no restrictions on the use of funds obtained through Shopify Capital Loan, it is recommended to utilize the capital for business growth initiatives to maximize its benefits.

What happens if a small business is unable to repay the Shopify Capital Loan on time?

If a business defaults on a Shopify Capital Loan, it may impact future eligibility for additional funding and lead to collection efforts by Shopify.

![How to Grow Your Law Firm Using Digital Marketing [VIDEO]](https://platform.suaramerdeka.com/wp-content/uploads/2025/10/law-firm-marketing-strategy-1024x405-1-75x75.png)