When looking at Best Dividend Stocks to Consider in 2025: Is JEPI One of Them?, we delve into a realm of financial opportunities and strategic investments. This article sets the stage for an enlightening journey through the world of dividend stocks, offering valuable insights and perspectives to guide your investment decisions.

The following paragraphs will provide a comprehensive overview of dividend stocks, criteria for selecting the best ones, an analysis of JEPI as a potential dividend stock, and a glimpse into the future outlook for 2025.

Introduction to Dividend Stocks

Dividend stocks are shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks differ from other types of stocks, such as growth stocks, by focusing on providing a steady income stream rather than just capital appreciation.

Investors are attracted to dividend stocks because they offer a reliable source of passive income. This income can be especially appealing during times of market volatility when stock prices may fluctuate. Additionally, dividends can provide a sense of stability to an investment portfolio, making them a popular choice for income-oriented investors.

Examples of Popular Dividend Stocks and Their Historical Performance

- Johnson & Johnson (JNJ): Johnson & Johnson is a well-known dividend stock with a long history of paying consistent dividends. The company has a strong track record of increasing its dividend payouts over time, making it a favorite among income investors.

- Procter & Gamble (PG): Procter & Gamble is another popular dividend stock that has proven to be a reliable income generator for investors. The company's diverse product portfolio and stable cash flows have contributed to its ability to sustain dividend payments.

- Microsoft Corporation (MSFT): While not traditionally known as a dividend stock, Microsoft has emerged as a top performer in terms of dividend growth. The tech giant has steadily increased its dividends in recent years, attracting both income and growth-focused investors.

Criteria for Selecting the Best Dividend Stocks

When evaluating dividend stocks, there are several key factors to consider to make informed investment decisions. One of the crucial aspects is assessing the sustainability of dividend payments, as this indicates the financial health and stability of the company. Additionally, comparing metrics such as dividend yield, payout ratio, and dividend growth can help investors identify attractive dividend stocks.

Assessing Sustainability of Dividend Payments

To determine the sustainability of dividend payments, investors can look at the company's earnings growth, cash flow generation, and overall financial health. A company with consistent and growing earnings is more likely to sustain its dividend payments in the long run.

Moreover, analyzing the payout ratio, which is the percentage of earnings paid out as dividends, can provide insights into whether the company can afford its dividend obligations.

Comparing Dividend Yield, Payout Ratio, and Dividend Growth

Dividend Yield

The dividend yield is calculated by dividing the annual dividend per share by the stock price. A higher dividend yield indicates a higher return on investment for investors.

Payout Ratio

The payout ratio is the percentage of earnings paid out as dividends. A lower payout ratio suggests that the company has room to increase dividends in the future or reinvest in the business.

Dividend Growth

Analyzing the historical dividend growth rate can help investors assess the company's commitment to increasing dividends over time. Consistent dividend growth is a positive indicator of a company's financial strength and management's confidence in the business.

Overview of JEPI as a Potential Dividend Stock

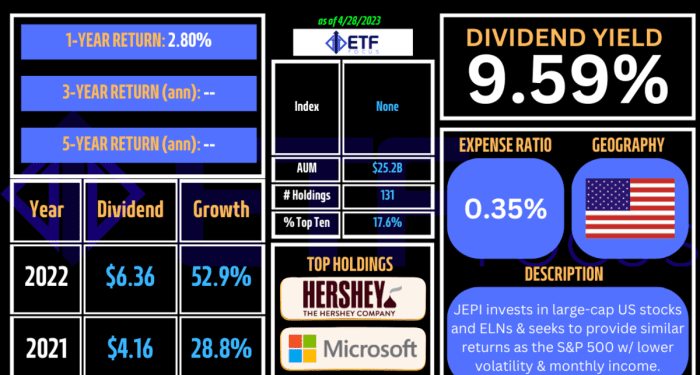

Introducing JEPI (JPMorgan Equity Premium Income ETF) as a dividend stock, we will analyze its historical performance in terms of dividends and total returns and compare it with other dividend stocks in the same sector or industry.

Historical Performance of JEPI

JEPI has demonstrated a consistent track record of providing investors with reliable dividends over the years. The ETF focuses on investing in high-quality, dividend-paying stocks, aiming to generate income for its shareholders. With a diversified portfolio, JEPI offers exposure to various sectors, providing a balanced approach to dividend investing.

Comparison with Other Dividend Stocks

When comparing JEPI with other dividend stocks in the same sector or industry, it is essential to consider factors such as dividend yield, dividend growth rate, and overall performance. JEPI's focus on high-quality dividend-paying stocks may appeal to investors seeking a steady income stream while benefiting from potential capital appreciation.

By analyzing JEPI's historical performance alongside its peers, investors can make informed decisions about including this ETF in their dividend stock portfolio.

Future Outlook for Dividend Stocks in 2025

Looking ahead to 2025, the dividend stock market is expected to continue its growth trajectory, driven by various factors that influence dividend yields and overall performance.

Expected Trends in the Dividend Stock Market

- The demand for dividend-paying stocks is likely to increase as investors seek stable income sources amidst market volatility.

- Companies with strong cash flows and a history of consistent dividend payments are expected to attract more attention from investors.

- Technological advancements and digitalization may lead to changes in the types of companies that are considered favorable for dividend investing.

Potential Factors Impacting Dividend Yields

- Interest rates set by central banks can significantly impact dividend yields, as higher rates may make bonds more appealing compared to dividend stocks.

- Economic conditions, such as inflation rates and employment levels, can influence companies' ability to sustain dividend payments.

- Global events, like geopolitical tensions or natural disasters, can create uncertainty in the market and affect dividend stocks' performance.

Macroeconomic Conditions and Performance of Dividend Stocks

- Strong economic growth usually bodes well for dividend stocks, as companies tend to generate higher profits and increase dividends during prosperous times.

- A recession or economic downturn can pose challenges for dividend stocks, as companies may struggle to maintain dividend payments amidst financial pressures.

- Government policies related to taxation and regulations can impact the attractiveness of dividend stocks for investors, influencing their performance in the market.

Closure

In conclusion, exploring the realm of Best Dividend Stocks to Consider in 2025: Is JEPI One of Them? offers a promising path towards financial growth and stability. With careful consideration and informed choices, investors can navigate the dynamic landscape of dividend stocks with confidence and foresight.

Key Questions Answered

Are dividend stocks a reliable source of income?

Yes, dividend stocks can provide a steady stream of income for investors, especially those seeking long-term financial stability.

How can I evaluate the sustainability of dividend payments?

One way to assess this is by looking at the company's earnings growth, cash flow, and dividend history to determine if they can maintain consistent payments.

What are some key factors to consider when selecting dividend stocks?

Factors like dividend yield, payout ratio, and dividend growth are crucial in evaluating the potential of a dividend stock for investment.